Fee-Free Stock Trading Platform – Attracting $280 Million Investment

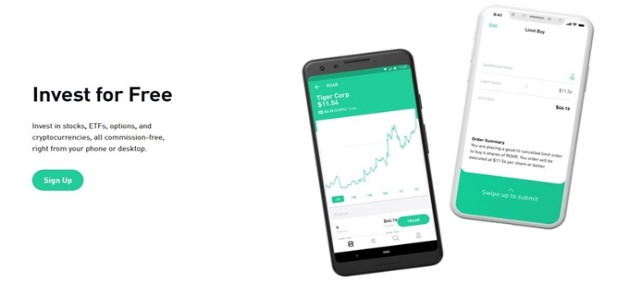

Robinhood is a stock brokerage that allows customers to buy and sell U.S. stocks, options, ETFs, and cryptocurrencies with zero commission.

Offers trading of stocks and ETFs without commission with a low-cost mobile app and site. Attracted investment with a corporate value of $8.3 billion through explosive growth over the past 7 years.

The main source of revenue is the premium service ‘Robinhood Gold’, which allows over-the-counter and margin trading, and interest from the explosive increase in subscribers’ deposits.

Robinhood

Robinhood Financial is a stock brokerage application that democratizes access to the financial markets.

The platform enables its customers to buy and sell U.S. stocks, ETFs, and options with zero commission. The trading platform also aims to make people comfortable storing money and trading stocks using its application.

General Information

- Headquarters : San Francisco, CA

- Founders : Baiju Bhatt, Vlad Tenev

- Categories : Bitcoin, Cryptocurrency, Mobile, Ethereum, Financial Services, FinTech, Personal Finance

- Founded : 2013

- Contact : support@robinhood.com

Funding

- Investors: 9Yards Capital, New Enterprise Associates (NEA), Ribbit Capital, Sequoia Capital, Unusual Ventures

- Funding Rounds (12) - $1.2B

- May 4, 2020 Series F / $280M

- Oct 29, 2019 Series E / $50M

- Sep 17, 2019 Secondary Market / $2.3M

- Jul 22, 2019 Series E / $323M

- Feb 1, 2019 Secondary Market

- May 10, 2018 Series D / $363M

- Apr 26, 2017 Series C / $110M

- May 7, 2015 Series B / $50M

- Sep 23, 2014 Series A / $13M

- Dec 1, 2013 Seed Round / $3M

- Sep 3, 2013 Seed Round

- May 1, 2013 Seed Round

1. Reason for attention

- Robinhood launched the app in 2013 with an easy-to-use stock trading model with no stock trading fees and minimum deposits.

- It has been called a revolution in the securities industry by leading the social phenomenon of 'ant entry into the stock market' and has achieved rapid growth, and is experiencing another rapid growth since the outbreak of the corona crisis in early 2020.

- At the beginning of 2020 alone, it attracted 3 million new subscribers, holding a total of 13 million accounts, and in June achieved 4.3 million DART (Daily Average Revenue Trade), surpassing other brokers.

- After attracting investment in May 2020, additional investments of $320 million and $200 million were received in July and August, respectively, with a market value of $11.2 billion at the time of final funding.

- There have been endless rumors of an IPO, and the market is expecting an IPO at the end of 2020.

2. Related Market status

- With the advent of Robinhood with a $0 fee, M1 Finance, Firstrade, Webull, etc. have eliminated the existing fee or launched a fee-free service from the beginning, and large corporations like Merrill Lynch also bank with a $0 fee to protect their customers. It caused a big sensation in the overall market, such as providing various rebates associated with of America.

3. Current service status

- Robinhood is rapidly growing by distributing a small amount of stock to recommenders and subscribers when they sign up with the recommendation of existing users, instead of lowering costs by not conducting separate marketing.

- However, recently, the problem of system stability and negligence in risk management for new investments by beginners in society has surfaced and a social issue has arisen.

- There have been a total of 47 system downs since March, and the system went down for two days in the midst of a sharp ups and downs in the US market in March.

- There are criticisms that the average age of customers is 31 years old, and it induces immature investors who lack financial knowledge to unwittingly engage in speculative trading such as short-term trading and option trading.

- A 20-year-old college student, a novice options investor, commits suicide after thinking he has lost $730,000.

4. Future Prospects

- Despite recent problems, the model of returning commissions to ants against the tyranny of commissions by the existing giant brokerage companies has revolutionized the market, and the advantage of being able to trade stocks without commissions by completing registration in just a few minutes is the Leading the generalization and popularization of stock investment.

Source: Robinhood

👉• Web: https://www.robinhood.com/

👉• Video: Robinhood - YouTube

0 Comments